The Yunus regime’s claims seem hollow of a strong economy, and having secured investment proposals of $1.25 billion in the first half of this year, as a top pharmaceutical company with significant US ownership, Renata PLC, recently mentioned the dollar crisis and political unrest for the delay in delivering goods.

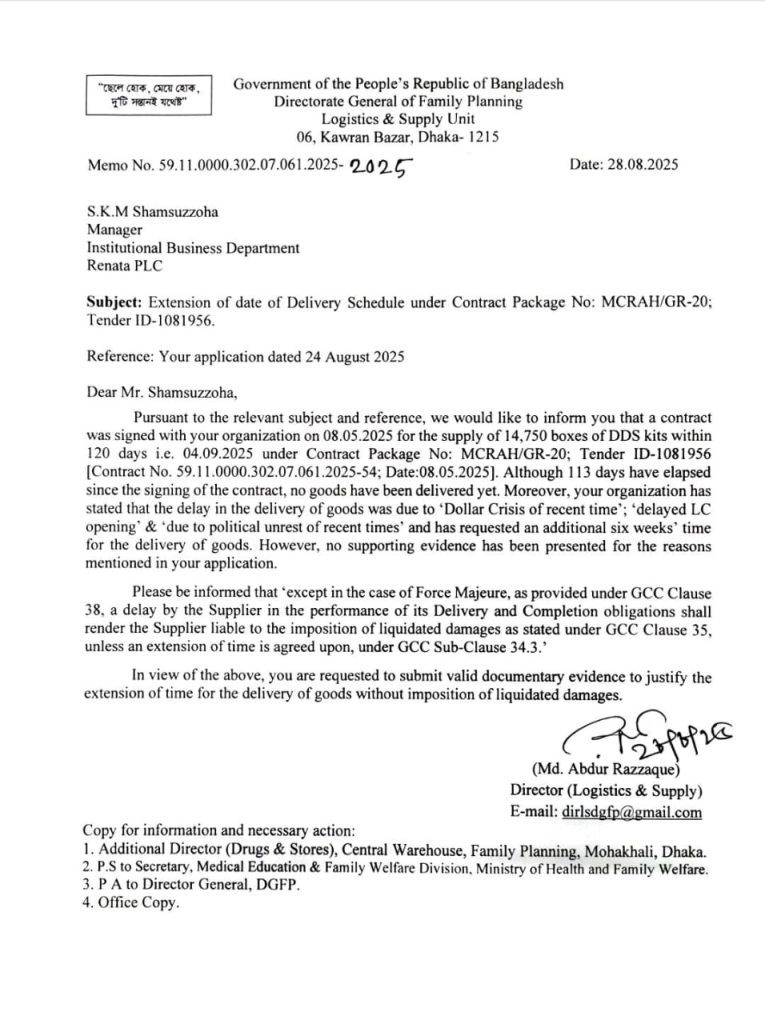

In a letter to the Directorate General of Family Planning (DGFP), S.K.M. Shamsuzzoha, Manager of Renata’s Institutional Business Department, said that the company was supposed to supply 14,750 boxes of DDS kits within 120 days or September 4 under a contract package signed on May 8.

Even though over 113 days have elapsed since the signing of the contract, no goods have been delivered yet. Instead, Renata requested an additional six weeks’ time for the delivery of goods, according to a government document seen by The Daily Republic.

The company stated that the delay was caused by the dollar crisis, the delayed LC opening, and the political unrest of recent times.

In response, the DGFP wrote a letter to Renata on August 28, requesting that it submit valid documentary evidence to justify the extension of time for the delivery of goods without imposition of liquidated damages.

The letter stated that “except in the case of Force Majeure, as provided under GCC Clause 38, a delay by the Supplier in the performance of its Delivery and Completion obligations shall render the Supplier liable to the imposition of liquidated damages as stated under GCC Clause 35, unless an extension of time is agreed upon, under GCC Sub-Clause 34.3.”

Balancing inflation and investment: Bangladesh Bank set to unveil monetary policy

Critical review of the U.S.-Bangladesh agreement on reciprocal trade

Md. Abdur Razzaque, Director (Logistics & Supply) of the DGFP, issued the letter, which was CC-ed to the Additional Director (Drugs & Stores), Central Warehouse, Family Planning; P.S. to Secretary, Medical Education & Family Welfare Division of the Ministry of Health and Family Welfare; and P.A. to Director General, DGFP.

Renata PLC has 52% local ownership, while 48% of its shares is owned by American companies. Early last year, Renata PLC began exporting medicines to the US market, becoming the sixth pharmaceutical manufacturer from Bangladesh to directly ship products to the world’s largest market.

The sorry state of the country’s economy is exposed by Renata at a time when the Investment Coordination Committee of the Chief Adviser’s Office (CAO), with Chief Adviser’s Special Envoy on International Affairs Lutfey Siddiqi, met on August 28.

The meeting was told that Bangladesh has received investment proposals of $1.25 billion in the first half of this year, from January to June. The proposals included $465 million foreign investment, $700 million local investment and $85 million joint venture investment.

But the reality is different.

The growth of gross domestic product (GDP) has fallen below 4% in the fiscal year 2024-25. According to the provisional estimate of the Bangladesh Bureau of Statistics (BBS), the GDP growth rate for the current fiscal year is 3.97%, amid a chaotic political atmosphere with uncertainty over the elections for a democratic transition, a poor state of the banking sector and downward GDP growth.

Why has Yunus aide Debapriya censured non-disclosure agreement in US tariff talks?

From Boom to Bust: How Bangladesh’s economy collapsed under Yunus regime

Economic crisis under Yunus regime: Reality and review

In the fiscal year 2019-20, GDP growth was 3.51%. Barring the special circumstances of the Covid period, the current rate is the lowest in any year in the last two decades.

Analysts say that while growth is the lifeblood of the economy, it alone does not tell us how people are doing. When the economy grows rapidly, new factories are built, the scope of businesses increases, and employment is created. People get jobs, and salaries and wages increase. As a result, families have extra money. With this additional income, they buy more goods and services, and spend on their children’s education and medical treatment. A kind of virtuous cycle is started in the economy. As a result, development is sustainable.

But when growth slows down, the first blow is to employment. As investment decreases, new industries or businesses are not being created as much. Companies stop hiring to cut costs, and layoffs begin in some places. This narrows the job market. If there is no work, people’s income decreases. Those who can keep their jobs also lose the opportunity for salary increases. If there is high inflation, then real income decreases further.

According to the theory of John Maynard Keynes, investment is the main driving force of growth and employment. When businessmen lose confidence and reduce investment, its negative impact spreads to the entire economy through its multiplier effect. Less investment means less production, less employment, and ultimately a contraction in consumer spending. Its effects are already visible in the stock market, with small investors being deprived of dividends.

Meanwhile, the World Bank, in its report published on Bangladesh in April, painted a bleak picture of the labour market. It said that many people are being forced to withdraw from the labour market due to the weak law and order situation, deteriorating business environment, and lack of employment opportunities. As a result, the labour force participation rate has also decreased.

A large number of people have lost their jobs in the factories that have closed due to political chaos since the fall of the Awami League government on August 5, 2024. At the same time, the situation has deteriorated further due to the slowdown in economic growth. Media reports have revealed that many workers have become unemployed due to the closure of factories in Gazipur. They are selling vegetables now.

The combined result of all this is an increase in poverty.

The World Bank fears that 3 million more people will be extremely poor in Bangladesh this year. As a result, the extreme poverty rate will increase to 9.3%, which was 7.7% last year.

According to the Power and Participation Research Centre (PPRC), the country’s poverty rate jumped to about 28% in May this year.

In 2022, the official estimate (Household Income and Expenditure Survey of the Bureau of Statistics) stated that poverty was at 18.7%.