By Shaiful Islam

In August 2024, under a unique political circumstance, an interim government was formed in Bangladesh led by Dr. Muhammad Yunus. Upon its formation, the government addressed the nation with a declaration that its sole purpose was to reduce political tensions through a neutral administrative process and pave the way for a credible election. However, the government has failed to reflect even a minimal sense of this intent in political, social, or economic domains. On the contrary, the overall national situation has escalated to a severe and unprecedented level in a very short time.

Alongside all other national matters, the financial competence and strategic foresight of this interim administration have also come under serious question. Particularly, on both national and international platforms, issues such as economic downturn, stagnant investment, and rising cost of living have become focal points of discussion.

Background and structural challenges of the interim government

The interim government under Dr. Yunus had pledged to uphold “moral and administrative neutrality” from the very outset—a promise that proved completely void in reality. Its immediate effects became visible in the financial sector. Ambiguities in economic policy, inefficiencies in budget implementation, and the lack of effective coordination with the private sector exacerbated the situation.

According to experts, political interests were the primary drivers behind the formation of this government. Though international factors were also at play, the economic strategy and policy preparedness were severely lacking.

Root causes of the ongoing financial crisis

1. Investment stagnation and market distrust

Almost immediately after the formation of the government, uncertainty arose among both domestic and international investors. Political instability, insecurity, land grabbing, violence, and terrorism created anxiety about the country’s political future.

Sheikh Hasina slams Yunus for economic crisis, lies, mobocracy

Sheikh Hasina reveals Yunus empire, built on ill-gotten money

Yunus’ provocations trigger further trade restrictions by India

Expatriates Betrayed: How the Yunus regime turned its back on remittance warriors

Budget: AL terms it cowardly in times of crisis, slams false campaigns

At the same time, the absence of transparent, inclusive, and business-friendly policies disrupted the planning of entrepreneurs and industries. Consequently, remittance inflow declined, and Bangladesh’s position regarding foreign loans became increasingly precarious.

2. Import-export imbalance

One major reason for the depletion of foreign currency reserves is the over-reliance on imports and the contraction of exports. Unnecessarily strained relations with neighbouring and allied countries, coupled with unbalanced ties with self-interested and regressive regimes, have undermined ongoing progress and cracked the trust of trading partners.

As a result, in the garment sector, buyer confidence has dropped, labour unrest has increased, and volatile dollar rates have led to a decline in orders.

3. Inflation and pressure on daily life

According to FAO data, Bangladesh ranks among the highest in Asia in terms of food price inflation. The price surge of fuel and agricultural inputs has severely destabilised the rural economy.

4. Policy weakness and indecision

The financial wing of the interim government repeatedly promised but failed to implement relief distribution, subsidies, and incentives for the agricultural sector. This policy vacuum has intensified the crisis, for which the government bears sole responsibility.

International reactions and assessments

1. Evaluations by World Bank, IMF, and ADB

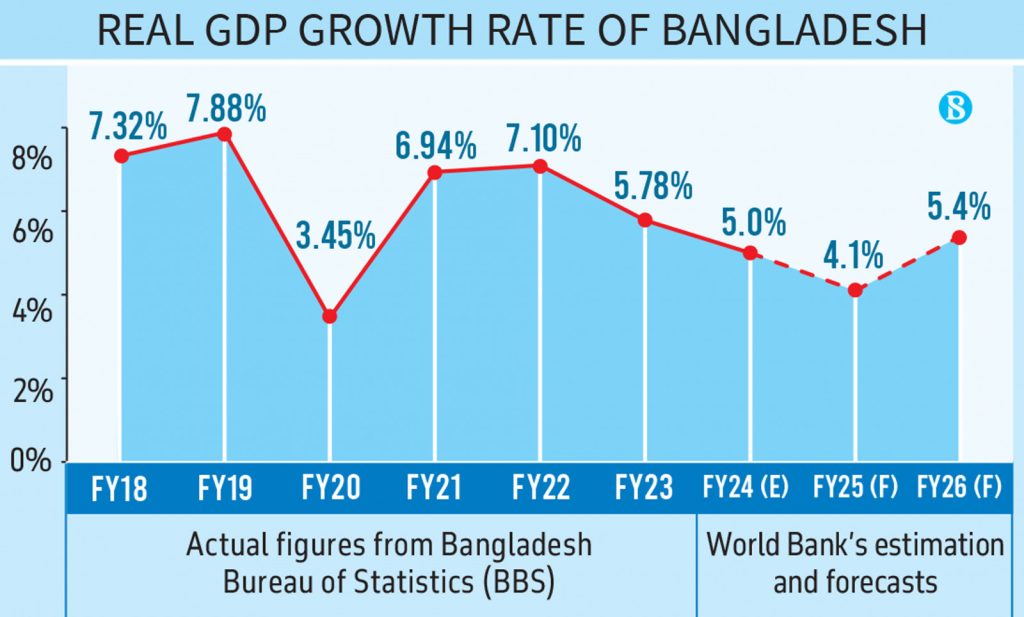

The World Bank has already warned that the budget deficit has crossed 6.9%, the highest in Bangladesh in recent decades. The IMF has proposed conditional assistance. Yet, despite frequently speaking of cooperation and partnership, the government has not publicly disclosed these conditions, thereby fueling public suspicion.

2. International media analysis

A recent article in The Economist titled “The Fragile Middle Path of Yunus’s Interim Government” noted: “Dr. Yunus has taken on more risk than his reputation can handle; assuming financial management without preparation has now cornered him both politically and economically.”

The report further stated that, despite the absence of any tangible steps towards economic stability or progress, Dr. Yunus’s desperate attempts to secure political support are pushing the country toward a long-term crisis that will undeniably paralyse Bangladesh’s future.

Real conditions and sectoral impacts

Garment sector collapse: Over 30% of export orders have been cancelled, and more than 100 factories have shut down (mob violence, lawlessness, and looting being major factors).

Collapse of the rural economy: Even though prices of rice, potatoes, and onions have fallen at the production level, market prices remain unbearably high. Prices of seeds, agricultural goods, and fertilisers have surged by 40%.

Power and energy deficit: Due to reduced reserves, LCs cannot be opened, the necessary equipment for electricity production is not arriving, and power generation has declined.

New analytical angles

1. Revenue collection and the influence of black money

Current revenue collection stands at only 7.8% of GDP, the lowest in South Asia. This has significantly constrained government spending (though development expenditures are shrinking, lavish and unnecessary luxury spending continues unchecked). Due to the lack of effective steps against black money flows, confidence in the domestic economy has deteriorated significantly. Corruption has become an open secret, where anyone with government ties or support can act with impunity.

2. Youth and employment

Unemployment among educated and highly educated youth has risen alarmingly. According to a BIDS survey, in the first half of 2025, 48% of university graduates were jobless. Growing fear of an uncertain future is fueling a brain drain. The Yunus-led government has taken no notable measures on this front. On the contrary, its policy of “auto-promotion” is pushing the nation toward a dystopian future devoid of merit-based competition and effort, rife with corruption and anarchy.

Though Dr. Yunus’s interim government began its journey with a pledge to resolve the political crisis, its deliberate political vendettas, extreme incompetence in economic governance, and total lack of planning are now driving Bangladesh’s economic future into complete uncertainty.

Sources:

1. World Bank Country Report, 2025

2. BGMEA Fact Sheet, Q2 2025

3. IMF Fiscal Review, 2025

4. The Economist, Reuters, Al Jazeera

5. BIDS Youth Employment Survey, 2025

6. Bangladesh Bank Monthly Reserve Update, June 2025

7. Bangladesh Bank Foreign Exchange Analysis, June 2025

8. Moody’s Investors Service, Bangladesh Credit Outlook, 2025

9. Bangladesh Investment Development Authority (BIDA), Q1 Report 2025